Photo courtesy of Philippine Information Agency

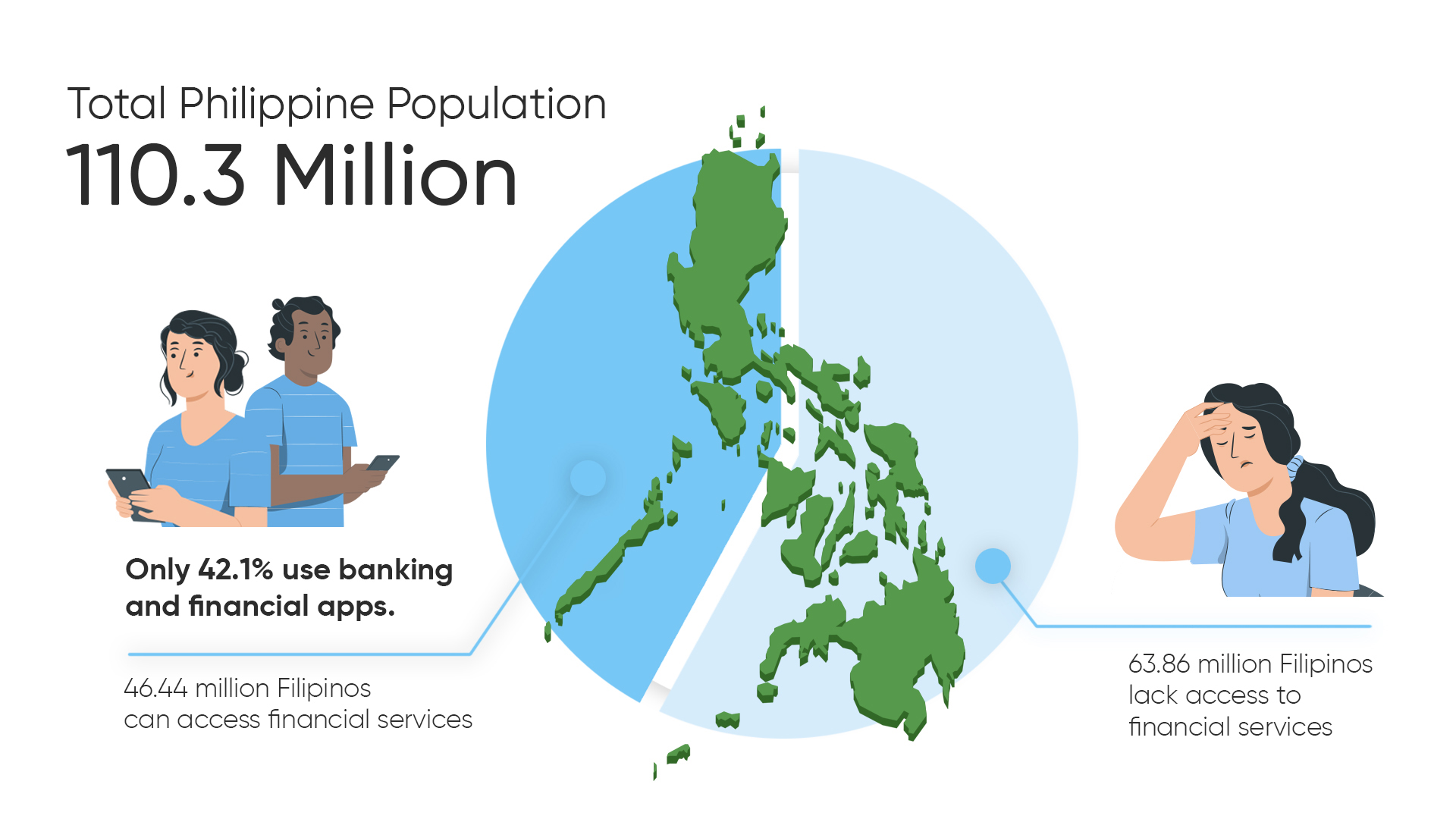

Did you know that only 42.1% of internet users in the Philippines use banking and financial services apps? This means that with a total population of 110.3 million, only 46.44 million Filipinos have access to financial services while 63.86 million are unable to. The lack of access remains as one of the barriers to improve financial inclusion in the country.

To address this, the Bangko Sentral ng Pilipinas (BSP) launched its Digital Transformation Roadmap. It aims to convert 50% of retail payment transactions to be digital and expand the number of financially included Filipinos to 70% by onboarding them to the formal financial system through payment or transaction accounts.

But how can we achieve this?

We can do it by helping institutions go mobile-first in the Philippines. According to We Are Social’s Philippine Digital Report 2021, there are 152.4 million mobile connections in the country. The use of mobile platforms allows Filipinos to access financial services more conveniently and support BSP’s Digital Transformation Roadmap goal.

Opportunities of Going Mobile in the Philippines

Photo courtesy of Freepik

The pandemic accelerated the use of digital and mobile solutions in the country. Digital payments grew significantly in 2020 as the volume of PESONet transactions grew to 15.3 million while InstaPay payments reached 86.7 million. Businesses have also moved to digital and mobile platforms to sustain their livelihood.

The financial industry is no exemption. Financial institutions have encouraged their customers to use their mobile banking platforms while some launched new mobile apps to continue serving the public even with community quarantine in place.

As more and more Filipinos now use digital platforms, understanding how to go mobile-first is relevant now more than ever. With the ongoing pandemic, we have to ensure the accessibility and availability of financial services to the public.

How Mobile-First Strategy Can Help Filipinos

Photo courtesy of CGAP Website

The pandemic accelerated digitalization in many ways. However, the majority of the Philippine population still lack access to digital solutions. Using a mobile approach can address this problem. Not only will institutions make their services easily accessible but also support the communities that they serve. Here are several reasons that emphasizes the importance of going mobile:

Photo courtesy of Yara FarmWeather

Onboard more Filipinos in the formal financial system

More people can be financially included, especially the vulnerable groups (low-income households, farmers, fishermen, and MSMEs.)

Photo courtesy of The New Humanitarian

Faster and easier access to financial services

Filipinos can apply for loans, open an account, and access other financial resources that they need to sustain their needs and livelihood with just their phone.

Photo courtesy of The World Bank

Help Filipinos transition to a cash-lite society

Financial institutions with the right digital foundation can connect to local billers in rural communities, encouraging the use of electronic payments (e-payments) even in far-flung areas.

Additionally, COVID-19 also changed Filipinos’ perspective on financial management. Based on Visa’s The New Normal: Pandemic Response Report, 81% of Filipinos believe that the current situation requires them to be more proactive about financial planning. Adopting a mobile-first strategy will make it easier for Filipinos to manage and plan their finances.

Going Digital: How to Go Mobile-First in the Philippines

The pandemic gave rise to the “New Economy.” As BSP Governor Benjamin Diokno explained: “The New Economy is an economy that is more inclusive. In connection with having a more technologically savvy population that is comfortable with using digital platforms to conduct their financial transactions, we are committed to reach more remote and far-flung areas through digital alternatives.”

This emphasizes that going mobile is more than just about being available on people’s phones. It’s about being fully digital. This requires institutions to have the right digital foundation to ensure full transformation. With the right foundation, you can integrate other digital solutions, participate in other industries such as supply chains, and engage in the “New Economy.”

But how can institutions go mobile-first in the Philippines?

Finding the right solutions provider guarantees that your institution’s needs are addressed. Financial institutions like rural banks and MFIs can support access to financial services anytime and anywhere. This, in turn, will ensure the participation of rural communities in the digital economy. Doing so can bridge the digital divide that prevents the unbanked and underserved sector from participating in the “New Economy” – helping us grow collectively in the long run.